Smart farming solutions are in global demand. Digitalization in agriculture and developments in AI, automation, sensor technologies, and robotics will create a USD 34 billion global market by 2026.

Digital farming in numbers

EUR 7.5

billion

domestic market volume for agricultural machinery in 2022

Number Three

producer of agricultural technology in the world

EUR 72

million

forecast software spending in the agriculture industry in Germany until 2024

One in six companies in Germany expects to invest in digitalization in the immediate future according to digital association bitkom. Around four in five companies also see digitalization as an opportunity. Artificial intelligence and big data solution uptake currently remains low (around 14 percent), allowing innovative SMEs and start-ups alike to capitalize from the future demand from almost 60 percent of companies intending to implement such solutions in the near future.

The global digital farming market value is forecast to rise to USD 34 billion by 2026. Worldwide, the largest digital farming technology segments are:

- Internet of Things (IoT), 19 percent

- Robotics, 17 percent

- Artificial intelligence (AI), 14 percent

According to forecasts, the global IoT agricultural market is set to grow by more than 90 percent to around USD 7 billion by 2025 – with Europe and North America representing the largest markets. Smart farming and agricultural robotic (“agri-robotic”) solutions are also expected to become significant agricultural trends in the near future.

Agriculture transformation in Germany

Agriculture in Germany is undergoing a structural transformation. The absolute number of farms and labor force has fallen as agricultural product demand has increased. In 2022, Germany was Europe’s second-biggest agricultural production nation with production value of more than EUR 74 billion.

Nearly half – 16.6 million hectares – of domestic land mass is used for agricultural purposes. Bavaria, Baden-Württemberg, Lower Saxony, and North Rhine-Westphalia are the federal states with the most agricultural land use. Arable farming accounts for over 70 percent of land used. Livestock husbandry is focused in the areas of beef, pork and poultry production.

The popularity of organic food in Germany has been growing exponentially in recent years in the EU’s most populous nation. And now Germany has set concrete targets for sustainable farming for the rest of this decade. In our video we take a look at what’s up down on the farm in Germany and how your business could benefit.

Digital farming market opportunities in Germany

Germany provides a plethora of exciting market opportunities to companies active in the field of digital agriculture. Below we list just a few of the segments where new opportunities are presenting themselves to SMEs and start-ups alike.

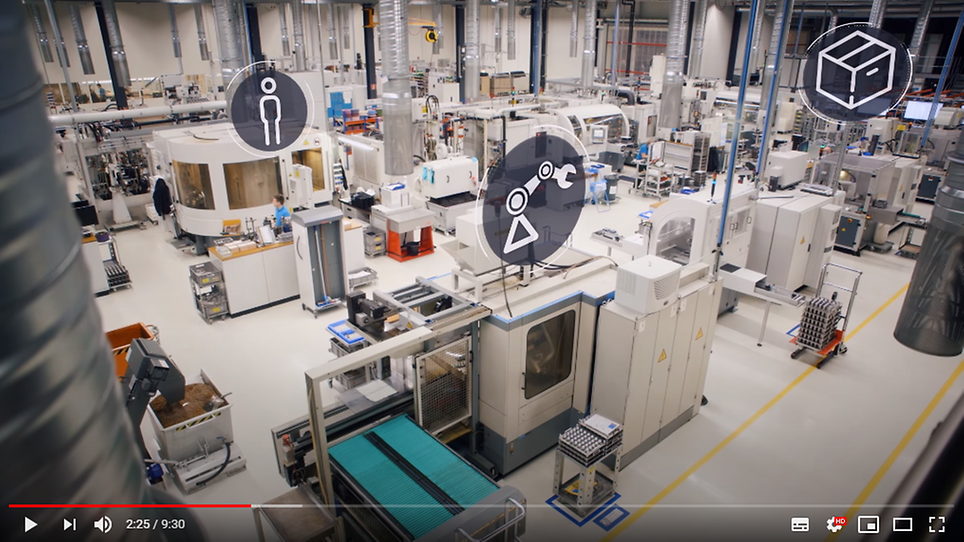

Agricultural machinery manufacturers meet digital product and service providers

Germany is the world’s third biggest producer of agricultural machinery and is home to a domestic market valued at over EUR 7 billion in 2022. Agricultural machinery manufacturers diversifying into autonomous farming, alternative powertrains and ICT solutions require cooperation with digital product and service providers. Data collection and processing and intelligent automation technologies are also important focal points in new machinery development. Agricultural businesses tend to source machinery from an array of producers, creating a marked preference for solutions that allow digital connectivity between machines.

Commercializing autonomous field robots

Global market volume for agricultural robotics (“agri-botics”) is expected to grow to almost 36 billion units by 2030 according to an Agricultural Robots Market study. Small-machine autonomous field robots (AFRs) represent one promising solution to the chemically treat crop and plant diseases with pesticide microdoses. Autonomous systems increase work safety by reducing contact to substances and free up labor for the cultivation of specialty crops for example. Autonomous field robots could enter into commercial production as early as 2030.

Artificial intelligence and precision farming

Precision farming allows domestic farms to respond in real time to changes in the weather, soil and soil conditions, water supply and other quality characteristics that impact upon crop growth. The implementation of AI and software precision farming solutions frees up resources and improves product quality. The Federal Ministry of Food and Agriculture is supporting EUR 44 million funding to 36 collaborative AI research projects. Of these projects, 24 are crop production related, with a further four projects investigating the use of AI in animal welfare.

On the investment agenda: sensor technologies

Sensor technologies for animal husbandry use are currently high on the investment agenda of companies in the sector, with almost half of all domestic farms planning future investment according to bitkom. Sensors can also be deployed to determine crop biomass levels for the appropriate use of fertilizer and crop protection measures.

Digital solutions for organic farming

Germany is Europe’s largest organic food market. European Union and German federal regulations restrict the use of herbicides and promote the use of sustainable livestock husbandry. Demand for organic and sustainably farmed produce creates new opportunities for companies providing digital solutions to promote animal welfare and herbicide use reduction.

Location advantage: R&D in Germany

Germany’s world-class R&D institutes and universities are helping shape the future of digital farming. Working closely with industry and the farming community, Fraunhofer-Gesellschaft and Leibniz Association institutions are bringing innovations to market. Internationally active companies, small and medium-sized enterprises and start-ups are all at home in different industry clusters across the country.

Digital farming funding

Germany supports digitalization in agriculture through a number of initiatives and programs. Specialized R&D funding programs have been created to promote the development of digital agriculture technologies. Research and development programs can provide up to 70 percent of eligible costs subject to company size and area of research activity.

Clusters and industry associations

International companies active in the digital farming sector enjoy ready access to agricultural technology clusters where farmers, machinery manufacturers, agrotech start-ups, universities, and research institutes work together. Stakeholders are organized in regional networks including the Agrotech Valley in northwestern Germany, Agronym in Saxony, and Competence Network Digital Agriculture Bavaria in Bavaria.

Our R&D cluster map provides you with an overview of important actors across Germany.